Achievements of Scrutiny on “Travel Industry Bill”

Achievements of Scrutiny on “Travel Industry Bill”

The Bills Committee has held 17 meetings and completed 172 clause-by-clause examination in the past year to finally bring the scrutiny of the “Travel Industry Bill”(the Bill) close to the end. As the Chairman of the Bills Committee, I maintained communication with members of the industry and reflected their opinions to the Government in a timely manner. Many of my proposals were adopted, and the Government responded to the demands of the industry members and the community by initiating Committee Stage amendments (CSA). The major changes are listed as follows:

Attended the tea gathering held by the Hong Kong Association of China Travel Organisers (HACTO) on 19 July 2018; briefed HACTO members on the progress of the Bill scrutiny and its impacts on the industry

a. Clarification of Travel Agents can Recover Levy Payments from Consumers

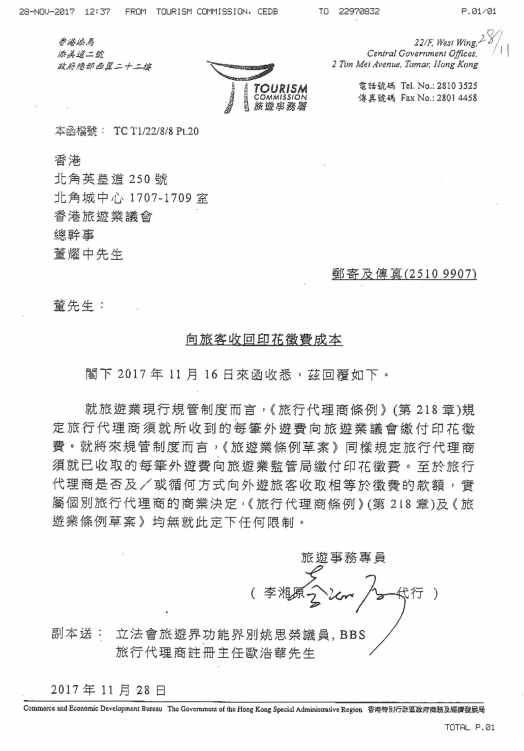

Regardless the fact that the “Travel Agents Ordinance” (the Ordinance) has been implemented for many years, it has only required the travel agents to pay the levy to the Travel Industry Compensation Fund. It has not, however, specified which party shall bare the tax burden. During the examination process of the Bill, I inquired the Government and received relative clarification: Whether to transfer the levy burden to the customers is a commercial decision of the travel agents, the Ordinance has imposed no restrictions on this requirement. The Travel Industry Council (TIC) has issued new guidelines in July 2018 in which advised clearly that members of the TIC can decide whether to charge the customers for the levy.

Reply from the Tourism Commission on levy payments recovery

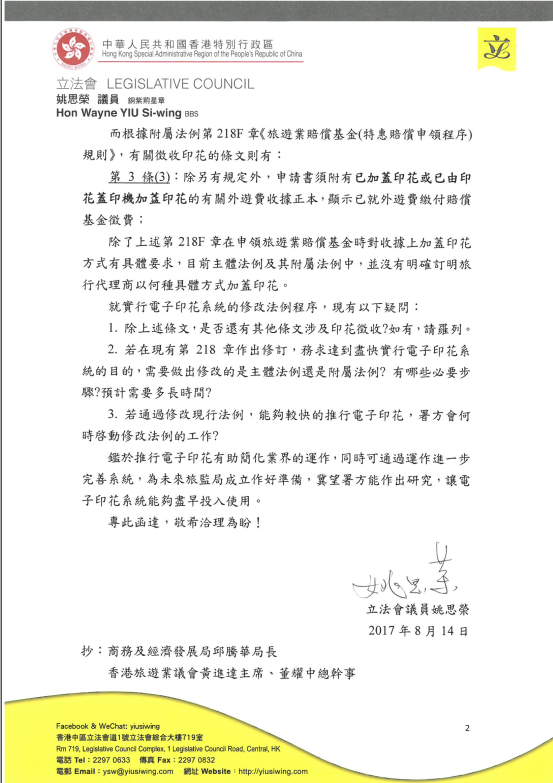

b. Urge for Early Launch of the E-levy System

At the initial stage of scrutiny on the Bill, the Government stated that an E-levy System had already been developed and would be put into service upon passage of the Bill and establishment of the Travel Industry Authority (TIA). I have examined the existing regulations and found that the E-levy System could in fact launch in advance. I immediately reported to the Government and my opinion was accepted. The E-levy System gradually put into service since 1 June 2018.

The E-levy System can provide consumers with receipts of levies paid in a timely manner, which can help avoid delays caused by traditional machines operation (especially for online transactions). We learnt our lesson from the disputes aroused from the collapse of Action Holiday, the incident was also a solid proof of the necessity of launching the E-levy System as soon as possible.

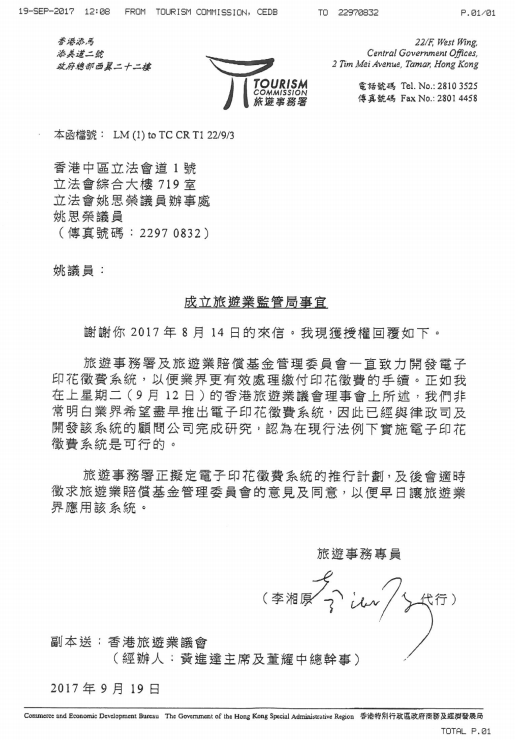

In August 2017, I wrote to the Tourism Commission to enquire the feasibility of advance implementation of the E-levy System under the existing ordinance

In September 2017, the Tourism Commission replied and accepted my suggestion on early implementation of the E-levy System

c. Requirement of Physical Store Premises will be cancelled in the Future TIA

As the change of consumption patterns, online transaction is now more popular than ever. Customers can complete transactions without visiting the physical stores in person, hence physical stores are not a necessity for travel agents. In this regard, the Government has accepted recommendations raised by me and members of the Bills Committee to carry out relative amendments. It is now clarified that upon the establishment of the TIA, it will ensure the Ordinance would be move with the times. Therefore, no business locations will be required for travel agents that face-to-face transactions with their customers is considered unnecessary; only a correspondence address will be required for communication purpose.

On 15 January 2018 a Committee meeting of the Bill was held - regarding the requirements for the business locations of travel agents after the establishment of the TIA.

d. Strive for Waiver of Liability on Levy Payment for Same Itinerary

Under current regulation, when customers purchase two or more travel products from travel agents, including transportation, accommodation or travel itineraries, levy will be imposed. However, even customers purchase products one by one at different timing for the same journey, they will still subject to the levy according to the Bill; and such pattern of purchasing single item at different time for the same journey has become a growing trend.

Members of the industry expressed their concerns on frontline staff may not be able to identify whether customers had made purchase for the same trip without the support of a system, given that the customer did not proactively remind us. If levy payments are not charged, not alone would it expose the consumers under the risk of not being protected, travel agents might also be liable for related legal responsibilities.

I arranged a number of meetings to allow discussions between members of the industry and the Government over the situation -- how to protect consumers while minimize the impact on the industry. Finally, the Government accepted the suggestion and proposed the waiver of liability.

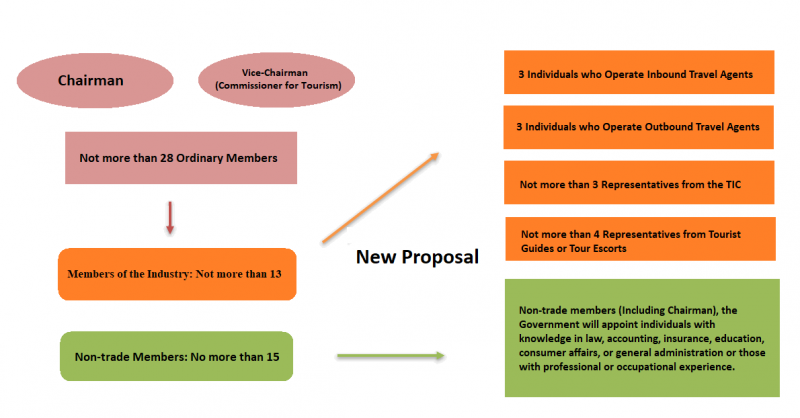

e. Strive for Inviting Representatives from Different Industries to Participate in the TIA

The Bill proposed that the TIA should be comprised of a Chairperson, a Vice-Chairperson and not more than 28 ordinary members. Under the industry members and my suggestions, the Government agreed to further subdivide the composition of members from the industry, so different industries would have the opportunity to join the TIA via their respective representatives.